When a loved one dies it is up to the officially appointed executor or personal representative to handle any tax matters for the deceased. If one has not been appointed by court or a will/trust, then the relative who has taken responsibility for the estate. In most cases this includes federal income tax. If your state has an income tax, you’ll need to file that as well.

You may be wondering about the federal estate tax. The good news is that only applies to estates larger than $11.4 Million (for 2019).

Before you begin

You’ll need to verify that the Social Security Administration has been notified of the death. Often, the funeral director takes care of this. Otherwise, you can call their toll-free number 1-800-772-1213 or visit the SSA website for more information.

File by April 15

Update: Due to COVID19, the tax deadline has been postponed until July 15 for all returns below $1 million.

When someone dies, taxes for any income they earned in their final year of life until the day of their passing is due on tax day the following year. For example, if someone dies in February 2020 and they earned money in 2020, their final income tax return is due on April 15, 2021.

In addition, depending on what time of the year someone has died, the deceased may have not filed the previous year’s returns. In the same example, if someone dies in February 2020, their 2019 taxes need to be filed by April 15, 2020.

A surviving spouse may file jointly unless remarried

You have two options if you’re the surviving spouse. You can file jointly or separately. Filing jointly is a little simpler and is still an option even if you’ve filed separately in the past. But if you prefer, you may still file separately.

As long as you haven’t remarried during that tax year, you can file a joint return. If that’s the case you’ll have to file with the option “Married filing separately” (MFS) on IRS Form 1040.

Qualifying widow(er)

If you are a surviving spouse and have dependent children living with you, you can claim yourself a qualifying widow(er) for up to 2 years after your late spouse’s death.

Do I need to file?

If the deceased was “married filing separately”, then the return will need to be filed if the gross income of the deceased was at least $5.

In all other cases consult this chart for 2019:

| Filing status | Age on day of death | Minimum gross income in 2019 |

|---|---|---|

| Single | < 65 | $12,200 |

| ≥ 65 | $13,850 | |

| Head of household | < 65 | $18,350 |

| ≥ 65 | $20,000 | |

| Married, filing jointly | > 65 (both spouses) | $24,400 |

| ≥ 65 (one spouse) | $25,700 | |

| ≥ 65 (both spouses) | $27,000 | |

| Married, filing separately | Any age | $5 |

| Qualifying widow(er) | < 65 | $24,400 |

| ≥ 65 | $25,700 |

How do I file?

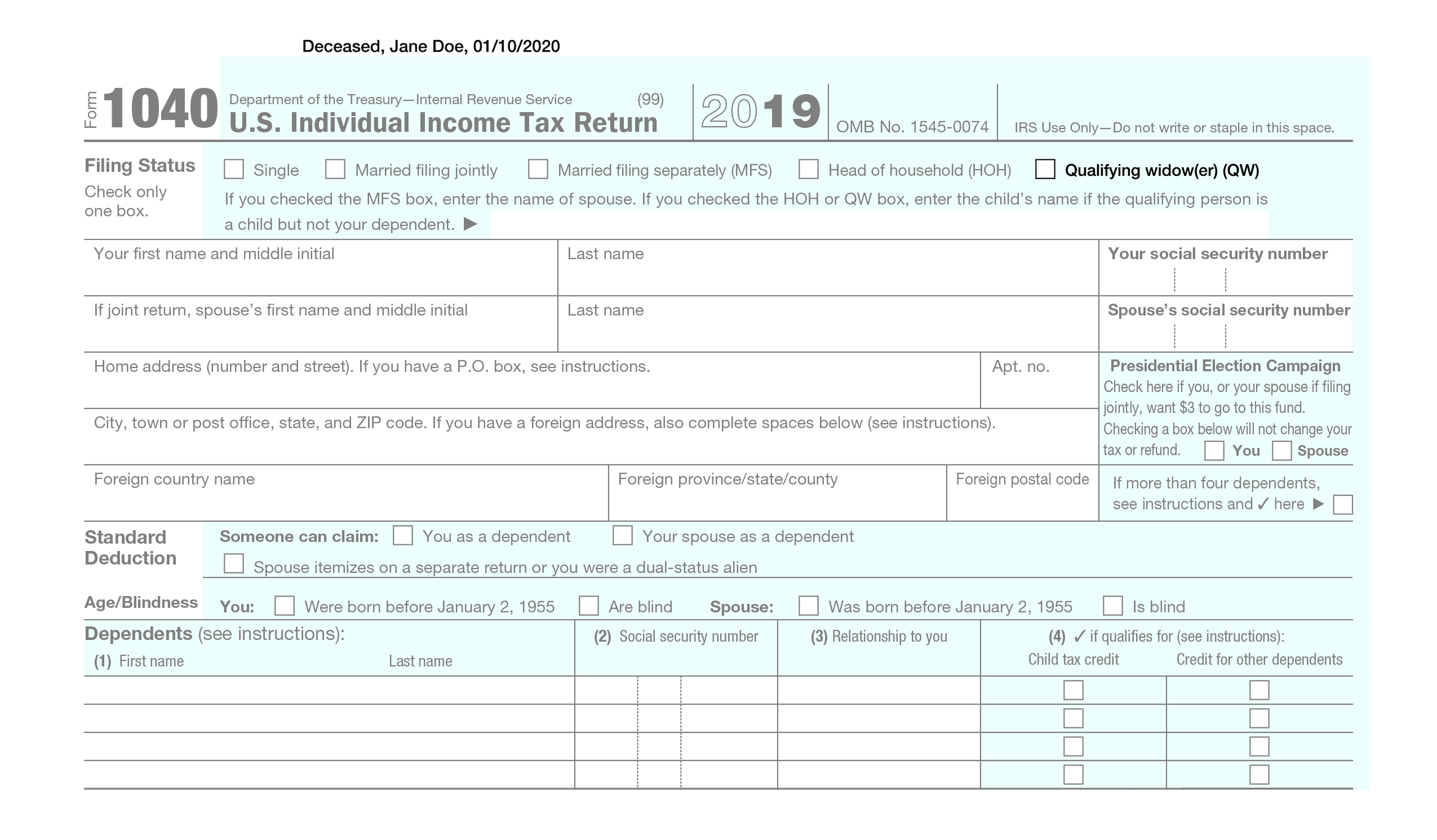

In the margin at the top of Form 1040, write Deceased, Name, Date of Death.

- On the top of IRS Form 1040, across the top of the form write the taxpayer’s name, “Deceased”, and the date of death.

- If you are the surviving spouse, filing jointly you need only proof that your name matches the name of spouse on the death certificate

- However, if you are not filing jointly, or are not the surviving spouse, you’ll need proof that you are the official named executor from the probate court in the form of Letters testamentary or Letters of Administration.

- If however, you don’t have proof yet, then you’ll need to fill out IRS Form 1310

How do I e-file?

Filing your taxes electronically is a convenient option. Especially, if the deceased had a history of e-filing. The IRS guide to the free options for filing your federal income taxes compares different services like TurboTax and Tax Act that offer free filing as well as a platform for filling out your own forms for free.

TaxAct

To enter the death of a taxpayer for a Federal return in TaxAct:

- Under Federal Quick Q&A Topics, click Basic information to expand the category

- Then click Taxpayer or spouse deceased.

- Enter the date of death and TaxAct will print “Deceased”, the name of the decedent, and the date of death at the top the Form 1040. As mentioned above.

TurboTax

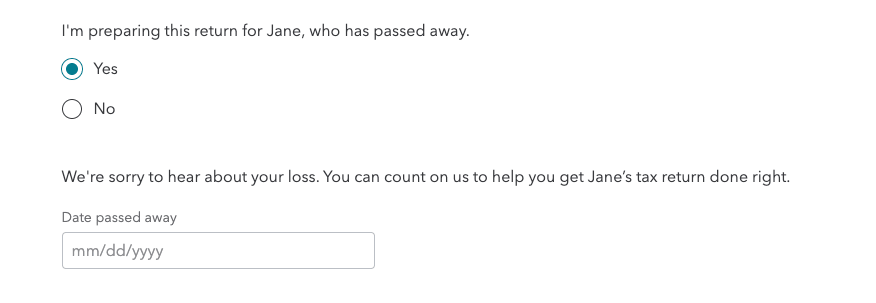

To enter the death of a taxpayer for a Federal return in TurboTax:

- In the sidebar, find My Info under 2019 Taxes (or the year in which you’re filing for)

- Scroll to the bottom under 3. A few other things we need to know

3. Choose Yes for the question, “I’m preparing this return for NAME, who has passed away.”

- You’ll then see a new question asking for the Date passed away. Enter the date of death and TurboTax will print “Deceased”, the name of the decedent, and the date of death at the top the Form 1040. As mentioned above.

How do I request previous returns

You may need access to previous years returns. Perhaps, you’ll find them around the house or have access to them digitally. But if you need to request them from the IRS or an online tax preparer (TurboTax, TaxAct), you’ll need proof of the death and your role:

- A copy of the death certificate (with matching surviving spouse name)

- For non-spouses, IRS form 56 to mark them executor of the estate and Power of Attorney for the deceased. In this case, the identifying number will be the deceased’s Social Security Number.

Income after death is part of the estate income tax return

If the deceased received income after death such as interest on a bank account, you may need to file IRS Form 1041 if the gross income for the tax year is at least $600.

Before you can file, you’ll need an Employer Identification Number

- Apply for an EIN from the IRS

- This number is required on IRS Form 1041 in box C at the top right.

- You’ll also need the EIN for IRS Form 56 to provide notice of a fiduciary relationship to the estate.

You MAY deduct

- The minimum gross income amount of $600

- The expenses of administering the estate

- The losses on the sale of any estate asset

You may NOT deduct

- Funeral expense

If the estate is open and still has income 2 or more years after the death, you’ll need to file quarterly income estimates, using IRS Form 1041-ES.

Beneficiaries may need to pay taxes on inherited money

- Money inherited from a retirement account—401(k) or 403(b) or Traditional IRA, avoids probate court, but not taxes.

- Surviving spouses can defer this by rolling over into their own retirement account.

- Others can set up an inherited IRA and take the money out over several years.

- Life insurance proceeds are only taxable if they are paid in installments, a lump sum is not taxed

- U.S. Savings bonds are taxable and paid when redeemed.

IRAs

- Any contributions which were put into an IRA after-taxes can not count as deductions. These are typically Roth IRAs or Non-deductible IRAs, but it is possible to have non-deductible contributions in a traditional IRA.

- Mandatory IRS Form 8606 will help the IRS keep track of which contributions taxes have been paid on.